do pastors pay taxes on their homes

Many clergy members make the mistake of assuming their housing allowance is entirely tax-free. Paying Taxes Many clergy members make the mistake of assuming their housing allowance is entirely tax-free.

How To Set The Pastor S Salary And Benefits Leaders Church

A licensed commissioned or ordained minister is generally the common law employee of the church denomination sect or.

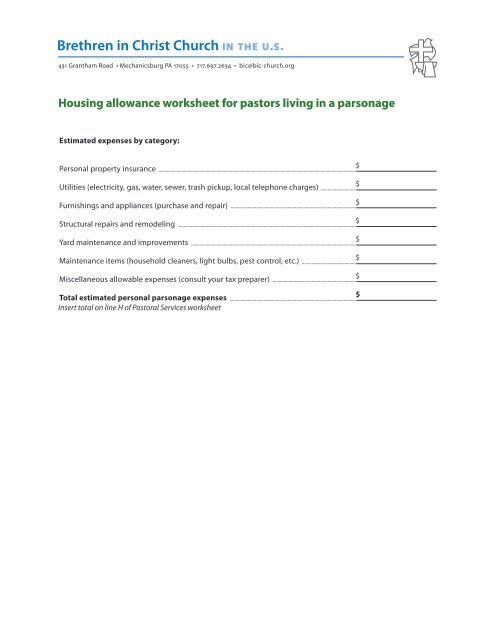

. The payments officially designated as a housing allowance must be used in the year received. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax. Regardless of the employment status of a pastor Social Security and Medicare cover services performed by that pastor under the self-employment tax system.

Do pastors pay taxes on their homes. Do pastors pay taxes on their homes. Honestly whether you tithe.

Include any amount of the allowance that you cant exclude as wages on line 1. Ministers rabbis cantors priests and other religious officials who work as leaders of religious organizations are entitled to have. Do pastors pay taxes on their homes.

Is tithing 10 of gross or net. This means that the pastors. Do pastors pay taxes on their homes.

Paying Taxes Many clergy members make the mistake of assuming their housing allowance is entirely tax-free. The big difference is that with self-employment tax pastors have to pay both their share of the contribution and the employer share and they pay it out-of-pocket. Do pastors pay taxes on their homes.

417 Earnings for Clergy. Whatever their status they must pay income tax to the IRS for all of their earnings. When a pastor is self-employed they may be able to deduct some of their home.

Although housing allowances can. Ministers rabbis cantors priests and other religious officials who work as leaders of religious organizations are entitled to have some of their income excluded from taxation. When filing for a return on their income tax for extra ministerial services pastors file a 1099 provided by their client.

How Pastors Pay Federal Taxes The Pastor S Wallet

Humanist Society Leader In Arizona Plans To Challenge Irs On Tax Break

9 Pastors Exempt From Property Tax

Miscellaneous Tax Deductions For Pastors Crown

Minister S Housing Parsonage Or Housing Allowance Servant Solutions

Religion Based Tax Breaks Housing To Paychecks To Books The New York Times

Long Island In The Region Parting With The Parsonage The New York Times

Pastors Parsonage Or Own Home Church Investors Fund

Five Quick Tips For Clergy Taxes

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Taxes Archives The Pastor S Wallet

What We Know Tax Payments And Filings For Churches And Individu Church Law Tax

Do Mega Church Pastors Pay Taxes Quora

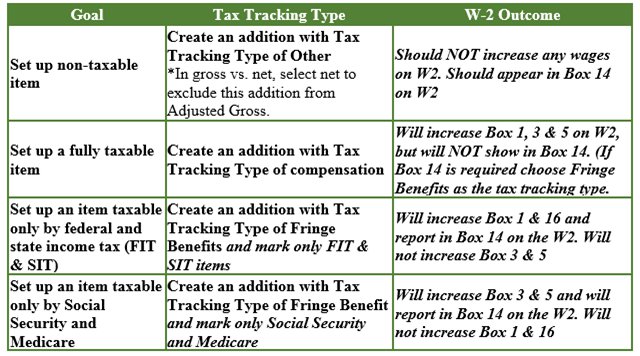

Payroll Set Up Housing Allowances For Clergy Members Insightfulaccountant Com

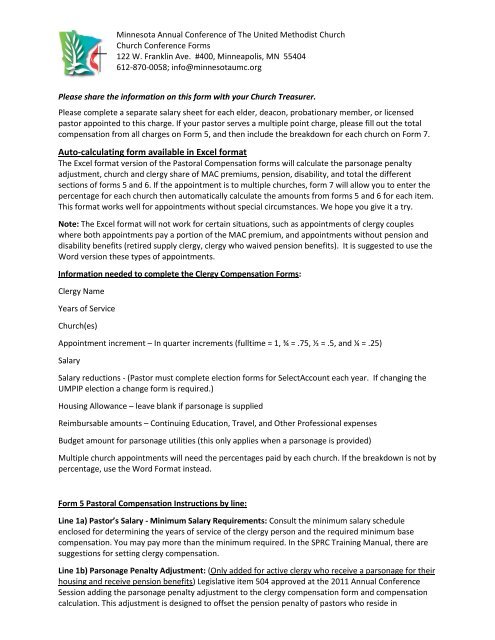

Forms 5 6 7 8a And 8b Clergy Compensation In Pdf Format

Chairman S Report March 29 2019 Fairtax Fairtax Org

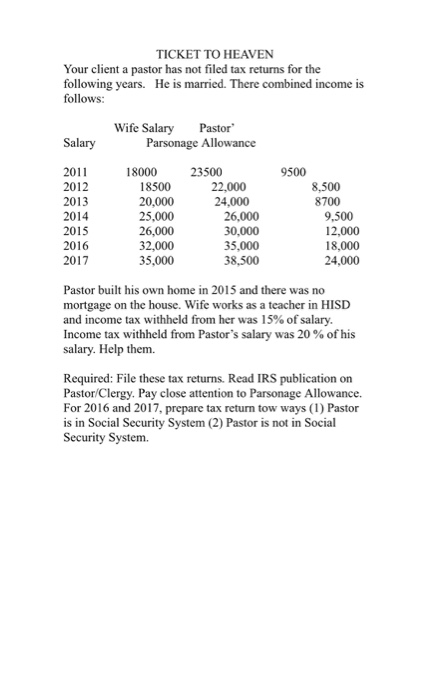

Ticket To Heaven Your Client A Pastor Has Not Filed Chegg Com